It may be hard to explain dental insurance to patients because it is so different from your typical medical insurance. It can also be difficult due to the fact that no two dental insurances run by the same rules or guidelines. Below, I am going to talk about the typical differences between medical and dental insurance. It is important to note that this applies to MOST dental insurances and could be not correct for some plans.

Main differences between medical vs dental:

- Deductibles: Deductibles are applied towards a visit from an office. The general idea is you must pay out of pocket that amount before your insurance will fully kick in.

- A. Medical Insurance traditionally has a higher deductible (Ex $1000) that you must hit before you won’t have out of pocket expenses for certain medical visits.

- B. Dental is the opposite. A patient will (not all plans do) have a lower deductible (ex $100) that they will need to hit prior to getting the traditional coverage of that service. Another thing different is depending on the plan, the insurance company will only put the deductible on treatment appointments. For example, some insurances will cover the preventative appointments at 100% and will only apply the deductible at treatment appointments (ex fillings, crowns). Some plans will consider x-rays treatment so they will apply the deductible to that procedure and treatment appointments.

- Maximum: The maximum amount of money dental insurances will pay in a given period of time.

- A. Medical insurance traditionally does not have this. Their deductibles are usually higher to account for this.

- B. Dental insurance almost always has a maximum that you must watch out for. Usually, any assistance plans will be the ones who do not have a maximum but they will have more strict frequency limitations

- Out of Pocket Investments

- A. Medical Insurance typically has a set copay for a regular doctor’s visit no matter where you are in your deductible.

- B. Dental insurance has many things that can affect this number. #1, how into the maximum the patient is, #2 how much coverage the insurance will provide, #3 what allowed amount is for the procedure, #4 if we are in or out of network for their insurance plan.

Waiting Periods

A waiting period is an amount of time after the purchase of the insurance plan the patient must wait to get specific procedures covered. Insurances either have these or not. Most insurances that have waiting periods are ones patients buy off the market (AKA not from an employer). The most common waiting periods are: 6 months for restorative, 12 months for crowns, periodontics, endodontics, oral surgery, prosthodontics, implants. Sometimes there will be an Orthodontic waiting period of 12 months or more.

Frequency Limitations

A frequency limitation is an amount of times a procedure can be done or how much time needs to pass before an insurance will cover the same procedure again. Every insurance company has frequency limitations on MOST procedures. Some insurance companies are more relaxed with them and some are very strict. It is important to follow the limitations as if a patient has a specific procedure before their frequency limitation is up, the insurance will not pay/ cover any of that specific procedure.

For example:

Some insurances cover a prophy (health gum cleaning) 2x per year. This is an example of a relaxed limit. They are only limiting how many the patient has per year, not the time in between. Theoretically, this patient could have two healthy gum cleaning sessions 2 days in a row, and the insurance would pay, but they would not allow for any more for the rest of their benefit period.

Another insurance company, a strict policy, would cover a prophy (healthy gum cleaning) 1x every 6 months. That means that this policy would require at least 6 months and 1 day before they would cover that cleaning.

These are some examples, you might see all sorts of different limits. Just note that if it says 99 per year, this is the symbol for no true frequency. That means we are not estimating a frequency for that procedure and the patient should be fine getting that procedure covered by their insurance policy.

Missing Tooth Clause

A missing tooth clause is stating that the insurance will not pay for replacements of teeth missing prior to the effective date of the policy.

Ex; If Kyle had a tooth pulled 10/15/2023, since his insurance started in November of that year and he has a missing tooth clause, the insurance will not pay for a replacement option (implant, denture, partial and bridge).

Predetermination/Preauthorization

A predetermination (pred) is what we ask the insurance specifically what they would cover for specific codes and procedures. We send a claim marked pred to the insurance that has no date of service to see what they said that they will cover. The good thing about predeterminations is that once the insurance says they will cover that specific amount, they must honor it. A pred is the ONLY WAY we can say for sure what the insurance will cover. Every other number we give the patients are estimates. The bad thing about predeterminations is that most must go through the mail, and that can take 1-2 months to get an accurate estimate back.

In Network vs Out of Network

To determine an out of pocket investment for a patient, you must look to see if their insurance is verified as in network. We partner with a lot of different insurance companies, but it is not guaranteed that we partner with each plan inside of the insurance companies. When talking to a patient, unless it is verified by the insurance team, it is important to NEVER promise that we are in network with their specific dental insurance plan.

Example of Verbiage:

“Do you guys except Metlife?”

“Yes! We accept most Metlife plans! A way we can check for sure is when we schedule your visit, our insurance team will do a complimentary benefits check to make sure we can give accurate out of pocket estimate information.”

What does in network (INN) or out of network (OON) actually mean?

In Network: It means that our practice has chosen to partner with that company to attract more patients. Basically, the insurance is allowed to cap (allowed amount) what we can charge for a procedure (this price has been agreed upon when the doctors become in network) and we will have to write off the difference.

For example:

If we charge $100 for x-rays, and Metlife caps the charge of that x-ray to $80, our practice will have to write off (not charge the patient) $20. And then if the insurance pays 100% of the x-ray, the patient would not owe anything and the insurance will pay $80.

Out of Network: If a patient is out of network, the insurance still gives a cap (allowed amount) on the most they will pay for a procedure. The difference here is that if there is a gap between what is allowed and what our fee is, we are not obligated to write off the difference.

For example:

If we charge $100 for the same x-ray from above, a different company (not in network) could still have $80 as the allowed amount. If the insurance pays 100% for the x-ray, they will only pay 100% of their allowed amount ($80). But since they are out of network, we do not have to write off the $20 difference between our fee and their allowed amount, therefore, the patient would owe $20.

*If you have further questions regarding this section, please talk to your team lead

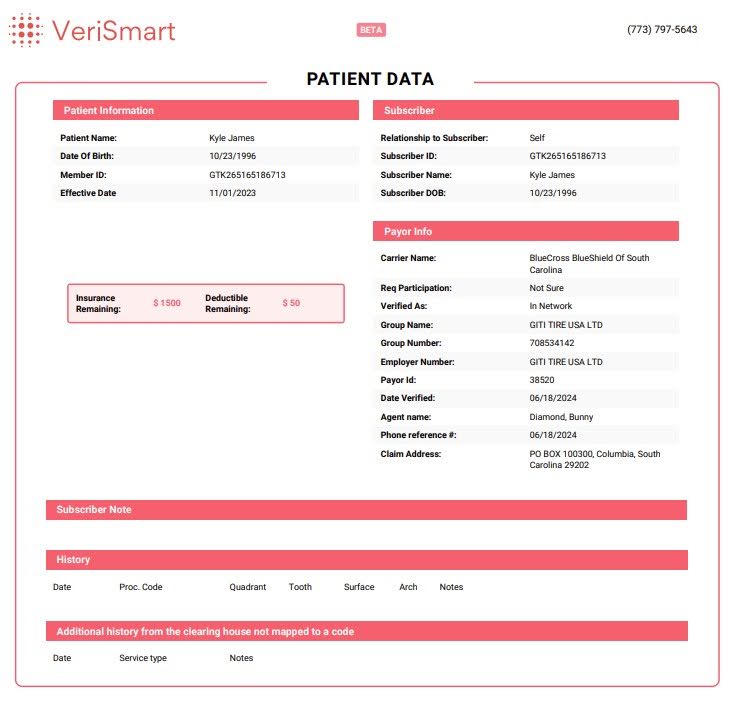

Below, you can see a verification from the insurance team prior to the patient’s appointment. You can see this document in a patient’s images, under Insurance. It should be labeled ‘VeriSmart Standardized Breakdown’.

In the first photo, you can see the maximum and deductible amount. That is how much the patient has throughout their benefits period (as long as this insurance stays active). Also, you can see on the left side that this patient’s insurance is verified as In Network and the insurance became effective 11/01/2023. Another thing to note is that on the bottom of that first page, there is a section that shows the history of this insurance use. Since there is none, Kyle has either never used this insurance or the insurance did not give us any information..

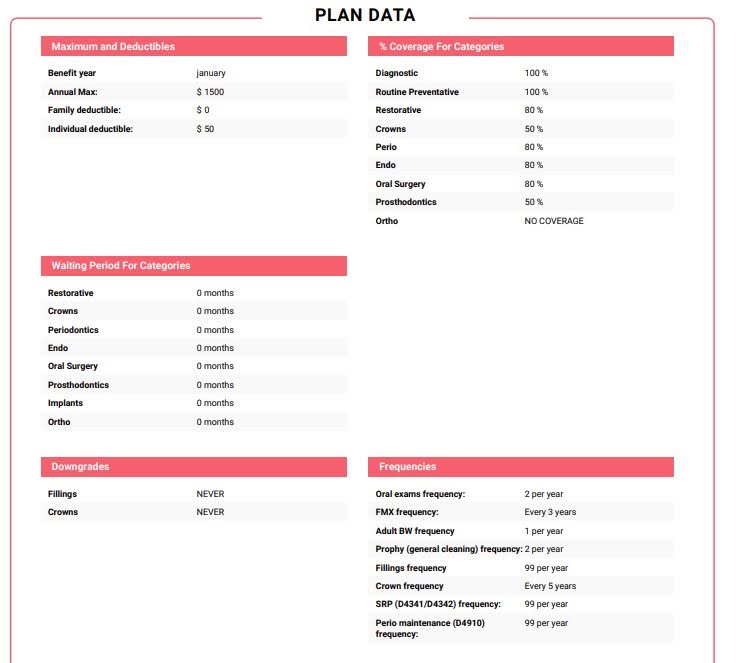

On the second page, this is where you get the most data. It shows when his benefits year renews: January. It shows the coverage percentages for specific types of procedures. It also will show if there are waiting periods if the plan has them, this patient has none. The second page is also home to the frequency limitations. It is best to be mindful of this section when scheduling any appointment, as if the limit is not met, then there is no chance the insurance will pay for them. Our office also does special procedures that need to be checked more for in depth verification. Some examples, you can find at the bottom of the second page.

Ex; some insurances will cover perio maintenance (gum management cleanings are perio procedures, some cover it as a routine preventative. The section labeled ‘Codes’ will show you what this insurance does for this patient. According to the verismart, Kyle’s insurance treats perio maintenance (gum management cleanings) as a perio procedure so if this patient receives that type of recare, he will always have an out of pocket.

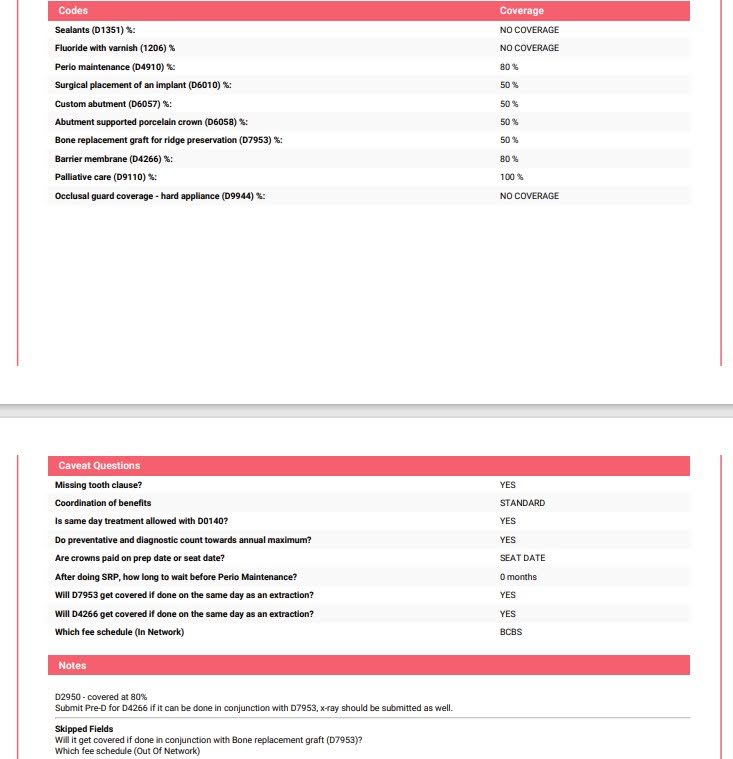

On the third page, you will find some more in depth information about the stipulations the insurance has to cover more procedures for a patient. The most looked at information on the third page is, ‘Is there a missing tooth clause?,’ ‘After doing SRP (gum treatment), how long to wait before doing perio maintenance (gum management)?,’ and any other special notes to consider. Another thing to look at on the third page is the notes section. These are specific notes from the insurance team to keep in mind or what they recommend to do for this patient.

Ex; ‘After doing SRP (gum treatment), how long do you have to wait before doing perio maintenance (gum management)?’ Kyle does not have to wait a certain amount of time after gum treatment to get a management cleaning done. Some insurances require you to wait, for example 3 months. When you plan a treatment plan for a person getting gum treatment, it is important to look here to give the most accurate information.

Ex; Kyle’s note in the third page says the d2950 (build up for a crown) is covered at 50%. Not all insurances cover the build up the same as a crown, it just happens that this policy does. The note is also naming specific codes they would recommend sending a pred for.