In financial notes

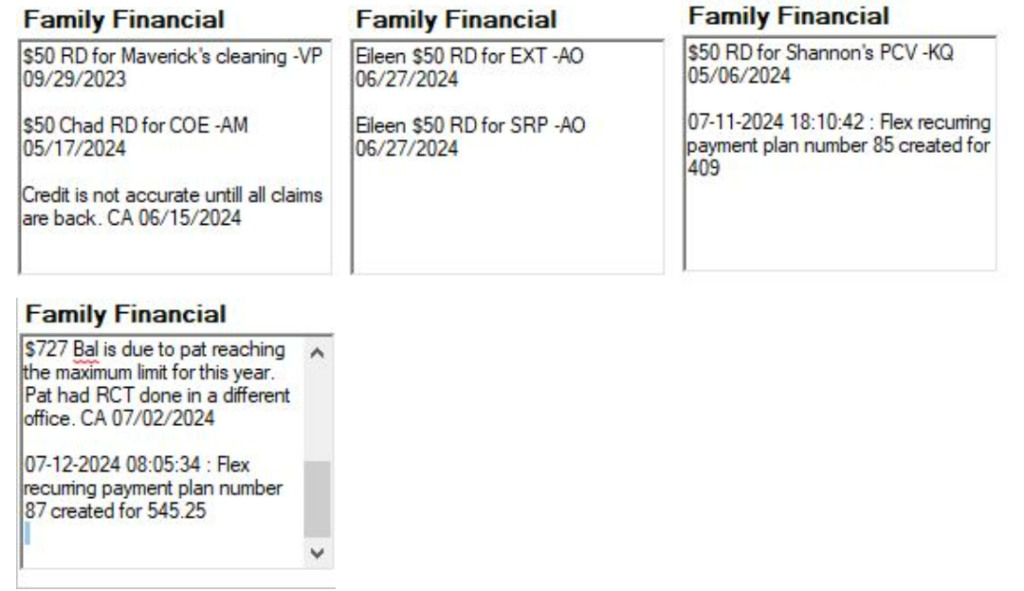

With a large team in multiple locations (BTS and out of the country), it is easy for things to get confusing and lost in communication. One of the things we do to combat this is making financial notes. Below you will see some examples.

Above are some examples of what the financial note may look like. They all indicate important information on what we can tell patients.

Ex 1: In their account, it might look like there is a credit for the patient to have refunded or use for an out of pocket investment, but according to Cathy, we want to wait to mention it. There could be a lot of reasons why this is, maybe we are waiting on insurance claims or the credit has not been officially checked for the whole family.

Ex 2: These are examples to know what each reservation deposit is for. This helps if a patient calls or at those appointment, to know what to use towards an out of pocket investment.

Ex 3: This person has a reservation deposit for her recare and then she also has a payment plan. One of the reasons a person could have a payment plan is our estimate on what an insurance company will pay is wrong and the patient may owe more so we are working with them to get the balance taken care of.

Ex 4: This person has a balance from an insurance reaching the max at another office so they owe more here. Below the balance note, you can also see that they started an in house payment plan with us to take care of that balance.

Cathy or the insurance coordinator will traditionally make the money/claim notes and then the business team will make reservation deposit notes. Now, things can be complicated in the moment when you are speaking to a patient, so if you have any questions about an account, tell the patient you will call them back with an answer and ask for help. The last thing we want is for patients to get the wrong information and then it get confusing for everyone involved.